Revitalizing Best Mart: End-to-End Data Engineering & Business Intelligence Strategy ?

A full-stack analytics project combining Azure SQL database design, Power Automate workflows, and Tableau storytelling to diagnose performance declines and optimize supply chain allocation.

📊 Executive Summary

Role: Analytics Consultant

Tools: Azure SQL, Microsoft Power Automate, Tableau, Excel, Microsoft Forms

Outcome: designed a scalable data infrastructure and developed a strategic roadmap to address a 7.79% Year-over-Year (YoY) sales decline and optimize inventory across 7 regions.

In this project, I acted as a consultant for Best Mart, a multi-regional retail chain. The company faced a systemic decline in performance in early 2021, specifically a 21% revenue collapse in the Sylhet region. My objective was two-fold:

- Build the data management system: Design a relational database to centralize sales and return data (SQL schema, ERD, automation workflows).

- Strategic performance analysis: Create an interactive Tableau dashboard to diagnose root causes and recommend business strategy recommendations for sales and marketing and supply chain teams.

🛠️ Part 1: Data Architecture & Engineering

To move Best Mart from reactive problem-solving to proactive optimization, I designed a centralized data system using Azure SQL Database.

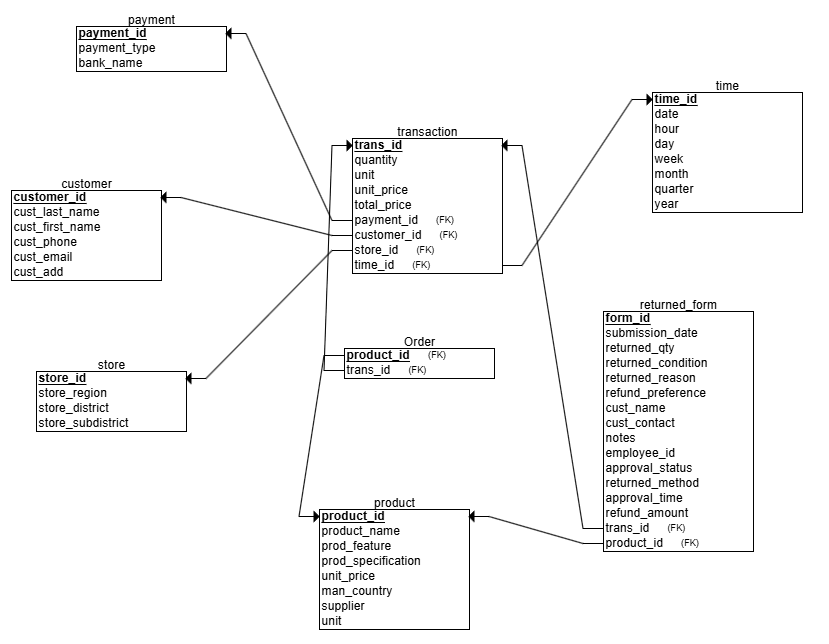

The Relational Schema

I moved the company’s flat files to a structured Star Schema to support efficient querying and historical analysis. The model integrates five core entities: Customer, Transaction, Product, Store, Payment and Time.

- Fact Table:

Transaction(Sales revenue, quantities, payment methods) - Dimension Tables:

Store(Regional data),Product(Categories, Suppliers),Customer(Demographics),Payment(Payment method, preffered bank)

Entity Relationship Diagram (ERD):

Automated Returns Workflow

One of the key operational bottlenecks was tracking product returns. I implemented an automated pipeline to sync return data directly into the SQL warehouse:

- Input: Customers submit data via Microsoft Forms and Employees review the recorded data via Microsoft Excel Online

- Processing: Microsoft Power Automate flows trigger upon submission.

- Storage: Data is automatically cleaned and inserted into the

Returned_Formtable in Azure SQL. - Action: This real-time feed alerts the supply team to quality control spikes (e.g., damaged “Coffee K-Cups”).

📈 Part 2: Analytical Business Insights

With the database live, I connected Tableau to the Azure SQL server to analyze the January 2021 performance crisis.

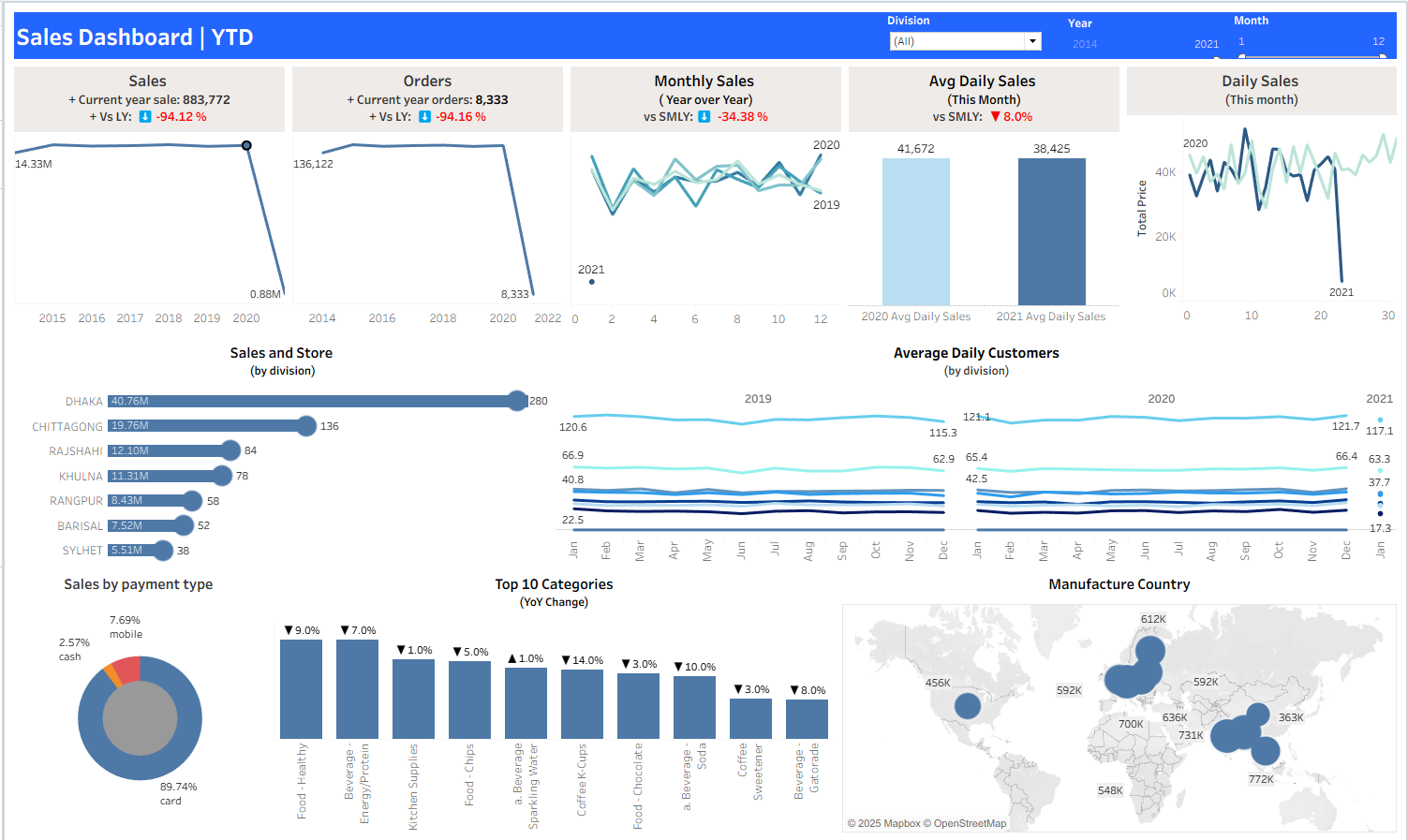

The Dashboard (Diagnostic)

KPIs tracked:

- YTD Sales

- Average Daily Orders

- Daily Active Users

- Payment Method Distribution

- Top Product Categories

👉 View the Interactive Dashboard on Tableau Public

The Storyboard: Tableau (Explanatory)

Narratives built for stakeholder

- Scenario 1 – Sales & Marketing

The diagnostic revealed several critical findings:

- The Traffic Crisis: While sales dropped 7.79%, the daily order count dropped even sharper by 9.2%. This indicated that the problem was lost customer traffic, not reduced spending power.

- Regional Disparity: While the core market (Dhaka) softened by 8%, the Sylhet region crashed by 21%.

- Strategy: market audit, retention campaigns, traffic-driver promotions, weekly KPI monitoring.

- Scenario 2 – Supply Planning

Deep-diving into Sylhet’s inventory, I uncovered a massive structural shift in consumer behavior, termed the “Coffee Ecosystem Collapse”:

- Dead Stock: In 2020, “Coffee Stirrers” were the #1 item. In 2021, they dropped to last place, with related items like K-Cups and Creamers falling by ~68%.

- Surge Demand: Conversely, durable goods like “Dishware - Bowls” saw a 113% surge in demand.

- Strategy: imports, expedite home goods, inter-store transfers, weekly volatility reviews.

💡 Part 3: Strategic Recommendations

Based on the data, I proposed a two-pronged recovery strategy:

1. Marketing & Operations (Q2)

- Market investigation: Rapid diagnostic audit in Sylhet

- Shift KPIs: Move from “Volume Discounts” (e.g., Buy 2 Get 1) to “Traffic Drivers” (e.g., Free Coffee with Visit) to address the 9.2% drop in footfall.

- Retention Campaign: Launch a “Dhaka Returns” campaign targeting the top 10% of lapsed customers with personalized re-engagement offers.

2.Chain & Inventory (Immediate)

- Stop Imports: Freeze Q2 orders for Coffee Pods/Creamers in Sylhet to prevent dead stock accumulation.

- Inter-Store Transfer: Transfer existing coffee inventory from Sylhet to Dhaka, where the category is still growing (+9%), effectively liquidating risk.

- Expedite Logistics: Air-freight “Home Goods” to Sylhet to meet the unexpected 113% demand surge before stockouts occur.

⚙️ Limitations & Next Steps

- Data scope: January 2021 only; risk of seasonal bias and lack of other datas: inventory, cost..

- External factors missing: competitor activity, infrastructure, political events.

- Next steps: expand dataset, integrate external variables, refine forecasting models.

Project Artifacts

- Interactive Dashboard: Click here to view

- Story - Performance Review: Click here to view

- Story - Supply Chain Deep Dive: Click here to view

- Presentation: Click here to view