Delivery Performance Deep Dive: What’s Driving Customer Dissatisfaction?

This project analyzes delivery order data from Cincinnati over a 30-day period, spanning September 16 to October 14, 2022. The dataset contains 60,583 entries across 19 columns, covering order details, delivery timestamps, driver assignments, and grocery partner performance.

🚨 Executive Summary

Our service is facing two critical challenges:

- Late Deliveries (4.7%) — driven by extreme delays in driver acceptance, especially for low-priced orders

- Order Accuracy (2.5%) — compromised by grocery store partners, leading to unresolved complaints

Recommended Actions:

- Restructure Driver Incentives — make low-priced orders more attractive

- Partner Success Program — deploy DashMart’s best practices across grocery partners

- Peak Hour Optimization — boost driver supply from 19:00 to 00:00

👉To reproduce this on the dataset or a similar dataset, you can follow the Jupyter Notebook

📊 Data Quality

- Data Quality: High, with minor completeness issues

- Low percentage of missing data:

DELIV_DASHER_ID,DELIV_D2R,DELIV_CLAT. These gaps are unlikely to affect most analyses. Therefore, I’ve chosen to drop null rows, as these fields are essential for downstream processing - Intentional Blanks:

DELIV_CANCELLED_AT,SUBSTITUTE_ITEM_NAME,CATEGORY

🔥 Market snapshot

- Total Orders: 60,583 (Sep 16–Oct 14, 2022, Cincinnati)

- Cancellation Rate: 1.1%

- Late Delivery Rate: 4.7%

- Missing/Incorrect Rate: 2.5%

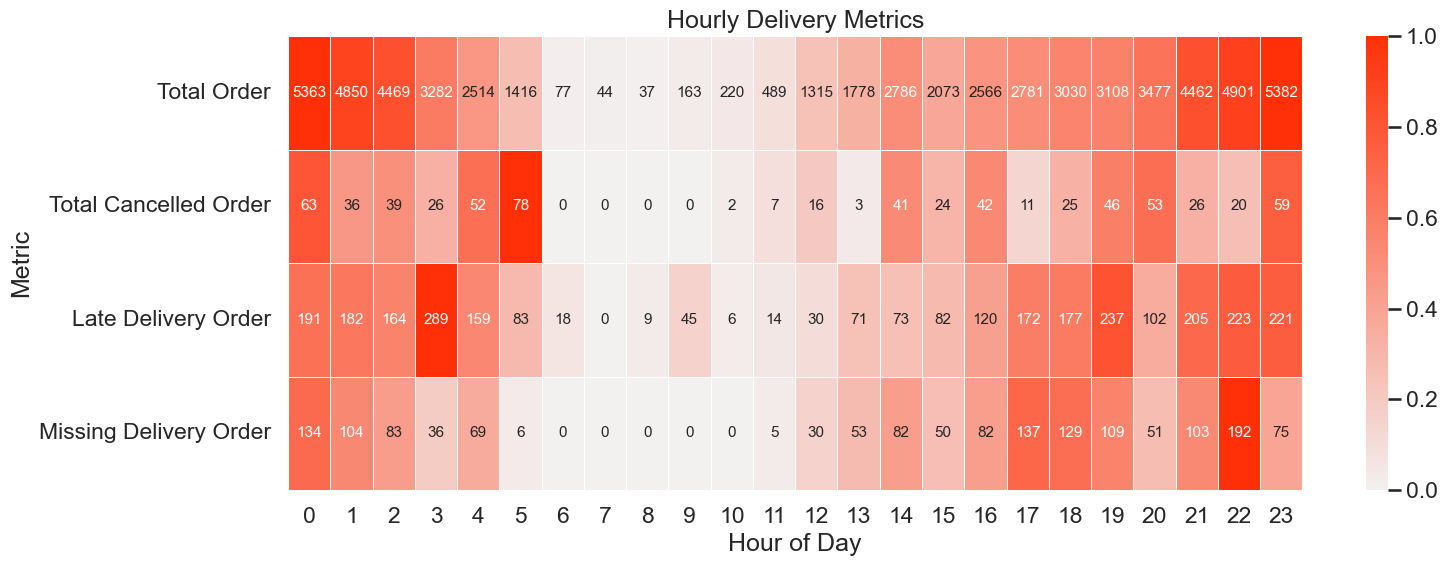

🔥 Market Patterns & Hourly Trends

- Order Peaks: 23:00–03:00 and 18:00–22:59

- Stable Hours: 06:00–11:00

- Critical Window: 19:00–00:00 — highest concentration of late and missing deliveries

- Cancellations: Low and consistent

🧍 Customer Experience

Order Accuracy:

- Resolution Gap: Only 8% of complaints were resolved with substitutions

- Mismatch Rate: 166 substitute items didn’t match original category

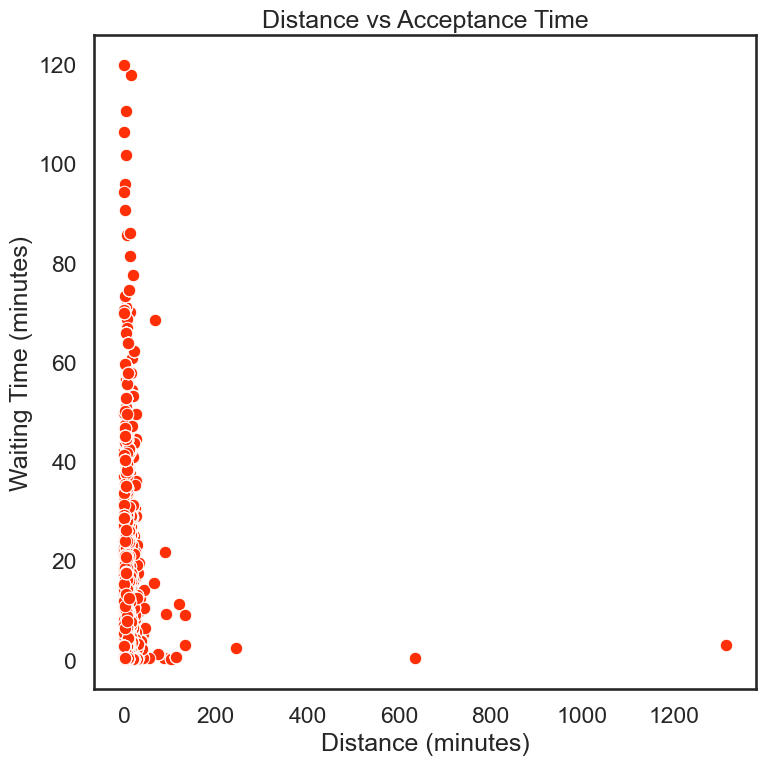

Wait Time:

- Median Acceptance Time: ~1.5 minutes

- Outliers: Up to 120 minutes

- Insights: Low-priced orders (< $0.20) ignored by drivers

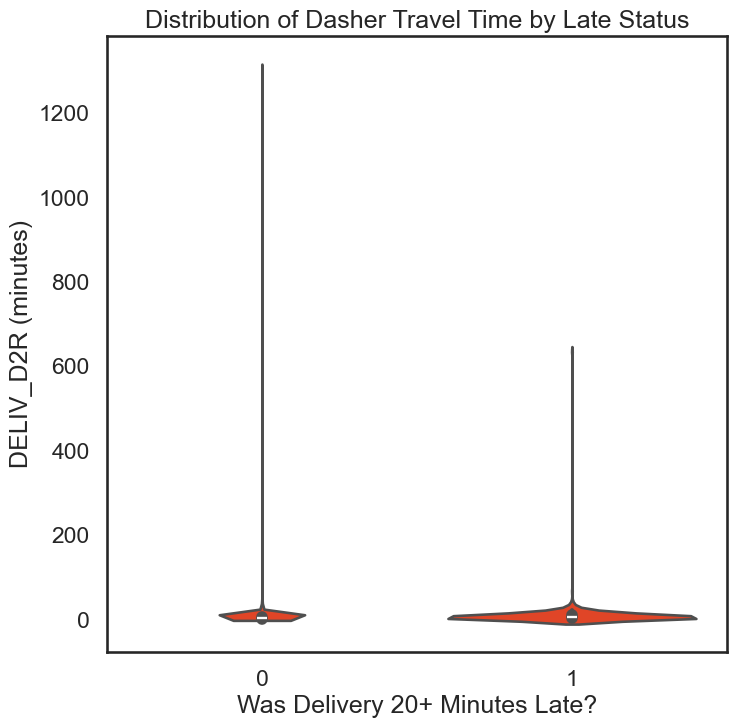

🚗 Dasher Performance

-

Travel Time Impact: Longer store arrival → higher chance of late delivery

-

Price Sensitivity:

- Orders < $0.20 → longest wait times

- Orders > $0.40 → fast, predictable acceptance

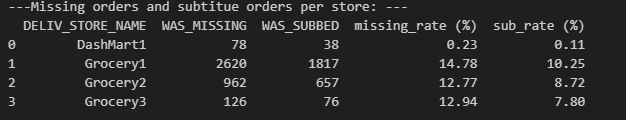

🛒 Merchant Reliability

DashMart vs Grocery Stores:

- DashMart:

- Missing Rate: 0.2%

- Substitution Rate: 0.1%

- Grocery1:

- Missing Rate: 14.8%

- Missing Rate: 14.8%

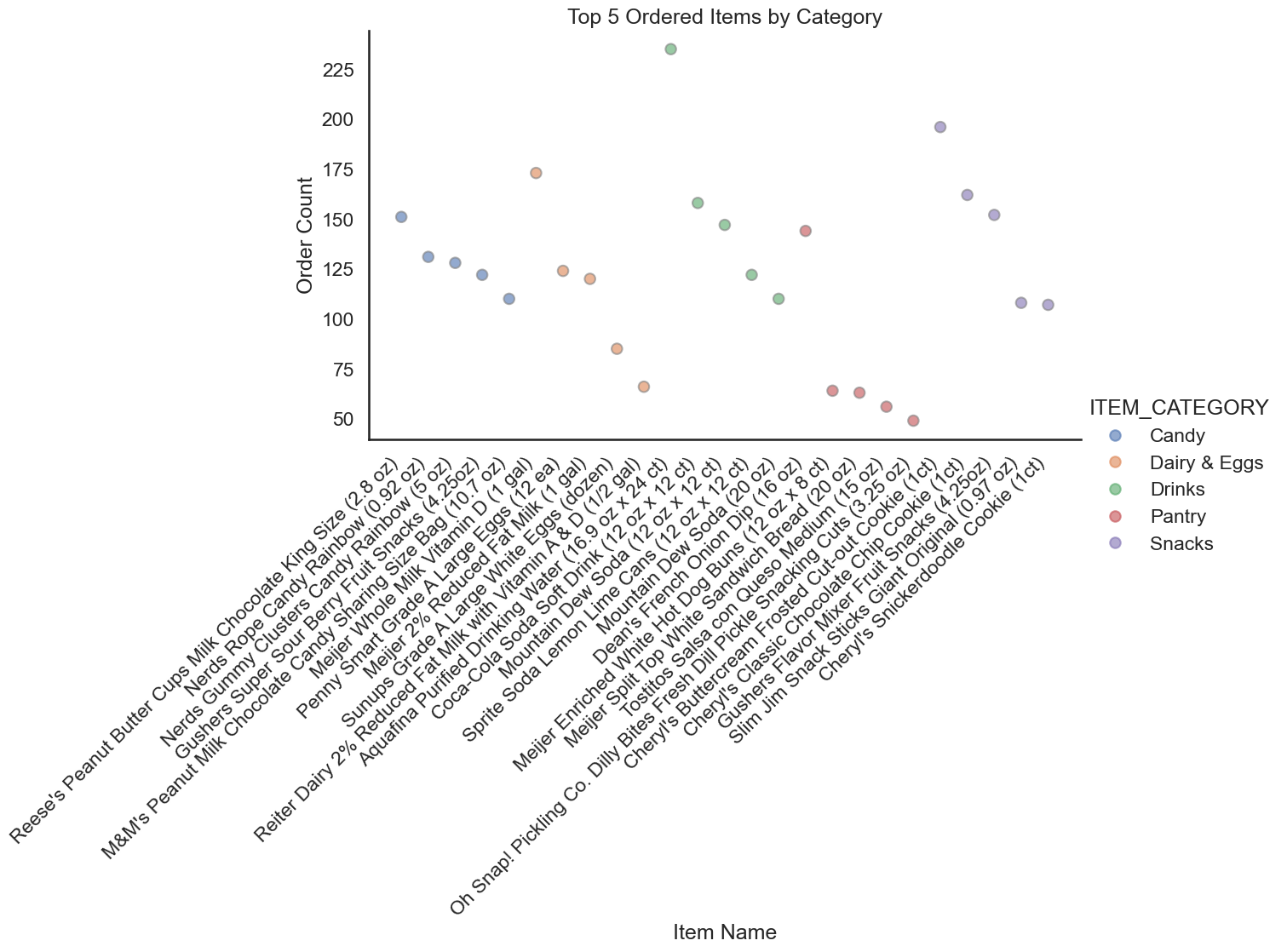

Menu Optimization:

- Share top 5 items per top 5 categories

- Help merchants stock popular items and improve substitutions

🧠 Strategic Recommendations

1. Fix the Small Order Problem

- Batching: Combine small orders

- Minimum Fare Guarantee

- Wait-Time Bonuses

2. Transform Grocery Partnerships

- Short-Term: Launch Partner Success Program

- Long-Term: Shift toward DashMart’s scalable model

3. Reinforce Peak Hour Operations

- Driver Supply Surge: Incentivize 19:00–00:00

- Push Notifications: “Evening Rush Bonus”